Currently, the garment manufacturing industry is thriving in Jamaica. It has become a major industry, which provides jobs to many people and generates revenue for the country. However, a number of questions are arising.

Some of them include whether the garment manufacturing industry in Jamaica has the capacity to meet the demand of the local and foreign markets. Regardless of the answer to these questions, the government needs to ensure that the sector continues to grow.

1 Textiles

Besides agriculture, the garment sector is a key contributor to the Jamaican economy. The industry employs about 1.5 million workers in 2,500 factories. It also exports a quarter of its products. However, it has recently been facing serious social and economic problems. In recent years, it has been the target of factory closures and decreased earnings.

In the late 1980s, the US textile firms began to lobby for lowering tariffs in the Caribbean Basin. They saw a potential opportunity in the region’s garment factories. The government of Jamaica responded with a comprehensive reform program. International and national support helped to make the government’s goals a reality.

The US moved cash into Jamaica, as did the Inter-American Development Bank and the World Bank Group. A support package of US$510 million was given to the country. This was part of the US’s Caribbean Basin Initiative (CBI), which was meant to stimulate growth by boosting export processing. In addition, the International Monetary Fund provided a four-year Extended Fund Facility (EFF) to support the private sector.

The Caribbean Basin Initiative helped to provide cheap labour, which was used by apparel brands to cut production costs. The garment industry earned US$159 million in 1999. In addition, the industry gained a duty-free access to the US market for a designated range of products.

However, the United States still imposed quotas on imports, which prevented local companies from developing their own exports. In 1998, a worker in the Free Zone (EPZ) received $4.50 a day, which was not enough to meet the basic needs of a family.

In addition to the US, Asian firms were subcontracting garment production to the Caribbean Basin. By the mid-1990s, South Korea was the largest investor in the region.

2 Clothing

Among the Caribbean nations, Jamaica boasts the top list of garment manufacturing companies. This list is a mix of the small and large, and is indicative of the country’s growing capacity for contract and non-equity mode of production.

The top list of garment manufacturing companies in Jamaica also includes the likes of the pharmaceutical, chemical, plastic goods and electronic assembly industries. This is due to the government’s policy of encouraging economic activity through the privatization of state owned enterprises, and is in keeping with the neo-liberal ethos of the time.

In fact, Jamaica’s real GDP growth rate for fiscal year 2015/2016 is estimated at 1.9 percent. The country has made significant progress towards restoring confidence in the Jamaican economy, and institutional reforms are starting to take hold. The government has also raised over US$2 billion in international capital in the past two years.

In addition to the above mentioned list, there are a number of other worthy of mention, such as the IndustriAll Global Union, which is part of the larger campaign for sanctions against the military junta. The aforementioned may be the simplest, and the best, example of the aforementioned enumerated items. The government also has been busy enlisting the services of the Multilateral Investment Guarantee Agency, which is promoting private sector development.

The top list of garment manufacturing companies also includes the likes of the pharmaceutical, carbonless paper, plastic goods and electronic assembly industries. This list is indicative of the country’s growing capacity to produce quality, affordable products that will keep consumers happy. This is due to the government’s policies of encouraging economic activity through the privatization of State owned enterprises, and is in keeping with the National Vision for Jamaica’s economy.

3 Food and beverage

Those who are involved in the beverage and food manufacturing industry know that there are many factors to consider when looking for suppliers. Some companies may offer an excellent product, but they may not have the best price.

Others might not have the right regulatory compliance, which is crucial for any manufacturer. You also want to consider the quality of the water used in the process. It is important to optimize the use of water because it is a critical input in the plant. Using the right water for the job ensures that your operation is safe and efficient.

Another consideration is the cost of the water. A large portion of the manufacturing and processing of food and beverage products involves water. This is due to the need for secondary processes, which include cooling, utensil washing, and environmental washing. It is important to optimize the amount of water used in these processes to reduce costs.

The Global Food Safety Initiative has been introduced to support primary production facilities, distribution, and storage of food and beverage products. This is particularly important in the beverage and food manufacturing industry because of the regulatory pressures involved. The SQF Code Edition 9 is the most recent version of the safe quality food (SQF) code, which is recognized by the Global Food Safety Initiative.

Some food and beverage manufacturers are now focusing on reducing their impact on the environment. They are doing this by optimizing their supply chain processes, developing new green technologies, and conserving natural resources. These industries have a long history of supplying quality products and services. But there is a need to be sure that they are complying with ever-changing regulations.

4 Tourism

Among the many things that teeter on the verge of bankruptcy are the garment manufacturing industry. In 1992, local firms produced about 15% of the domestic market. The industry was also responsible for about a quarter of all apparel exports.

The top garment manufacturers in Jamaica owe their success to a handful of factors. One is the aforementioned tsunami of foreign aid, but more important to these firms is the fact that China’s gargantuan investment in the island’s economy has pushed prices for imported textiles and apparel down. In addition to this, the country’s plethora of free trade zones beckons investors from Hong Kong and mainland China.

The nation’s financial health will be tested in the near term. Among other concerns, the national debt will be hit hard in the face of the slew of interest rate hikes. For its part, the government will have to find a way to cut costs without compromising on the quality of life for its citizens. Its stumbling block is the fact that much of its budget is earmarked for debt servicing. This will be a test of foresight and patience. The government will need to show the public that it is still in charge of its fiscal stewardship. Thankfully, the government has a plan for doing just that.

The top garment manufacturers in Jamaica can be found in all corners of the island. Some of the larger firms are located in the heart of Kingston and nearby St. James. Other smaller firms can be found in other parts of the island. Some of these companies operate as independent outfits, while others are part of larger conglomerates such as the Textile Manufacturers Association and the Association of Manufacturers of Textiles and Clothing.

5 Minerals

Despite the recent downturn in the industry, there are signs of a return to growth. The sector’s importance to the economy is evident. In 2018, mining revenues contributed over 2 percent to GDP. During the same period, the sector’s employment grew to more than 3,500 people. In addition, Jamaica’s mineral industry includes a thriving sand and gravel industry.

In 1957, Jamaica became the world’s number one bauxite producer. This was achieved because of the successful exploration program. In the six years that followed, Jamaica produced nearly five million tons of bauxite.

In the 1970s, the bauxite industry went through a significant shift. It became a wholly-owned subsidiary of aluminum companies. It was also affected by a prolonged depression in the world bauxite prices.

The Government of Jamaica has placed special emphasis on reclaiming mined-out bauxite lands. The country’s mineral industry is still driven by high-quality bauxite.

The government wants to increase the number of value-added mined areas. This is done through the establishment of new agencies, such as the Jamaica Bauxite Institute (JBI). This agency advises on all aspects of the bauxite and alumina industries. It also monitors the industry and provides research information.

The bauxite/alumina industry in Jamaica has strict environmental permitting processes. The government has a responsibility to ensure that the industry is run in an environmentally sound manner. The process is managed by the National Environment Protection Authority (NEPA) and the Jamaica Bauxite Institute.

In the early 1980s, the Jamaican bauxite sector suffered a huge decline. Six North American companies left the country. The loss of these companies pushed the country’s share of the world bauxite output down from 18.1% in 1974 to just over 9 percent in 1983.

Henry Pham (Pham Quang Anh), CEO of DONY Garment

Henry Pham (Pham Quang Anh), CEO of DONY Garment

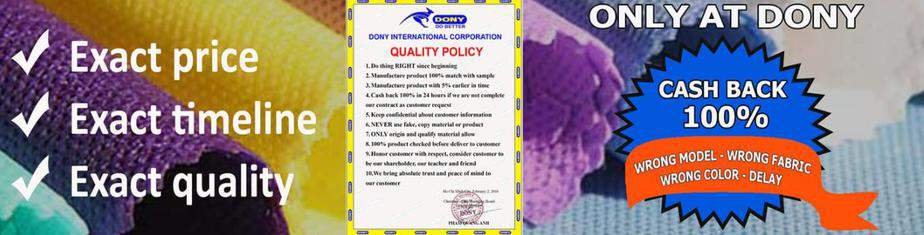

This year, we have found that many international buyers are seeking new suppliers based in nations outside of China and Thailand to purchase many goods and products, including uniforms, workwear, reusable cloth face mask, and protective clothing.

At DONY Garment, we are proud to welcome international customers, especially those based in the US, Canada, the Middle East, and the EU market to discover the professional production line at our factory in Vietnam.

We guarantee our products are of the highest quality, at an affordable cost, and easy to transport across the world.

Dony Garment Vietnamese Garment Factory Supplier – Apparel Clothing & Textile Manufactured. Private label clothing Produce women, men, children baby wear – Casual Clothing, Uniform, Workwear

Dony Garment Vietnamese Garment Factory Supplier – Apparel Clothing & Textile Manufactured. Private label clothing Produce women, men, children baby wear – Casual Clothing, Uniform, Workwear

Henry Pham (Pham Quang Anh), CEO of DONY Garment

Henry Pham (Pham Quang Anh), CEO of DONY Garment